During a meeting with employees, we asked the finance team to name the recurring issues that their clients were experiencing and for which we had relatively simple tools and solutions to offer them.

Among the issues raised: How to use financial statements as a management tool? How do we manage to resolve this issue? How is the analysis and reading of its financial statements done?

First, what do a company’s financial statements mean?

Financial statements are made up of accounting data that is collected in accordance with auditing standards over a well-defined period. They include 3 separate reports:

- The income statement, which presents the company’s profitability

- The balance sheet, which lists assets like accounts receivable and debts of the business like credits.

- Cash flow, which explains the use of company funds

Each report takes the financial pulse of the company and presents different information.

What are the objectives of financial statements?

Financial statements provide important information about the financial condition of the business. This data is used by the various internal and external users to make well-informed decisions regarding the company’s future financial strategy.

Objectives of Financial Statements for Accountants and Internal Management

The results obtained during the preparation of financial statements allow accountants and managers to:

- Check to see if they have made any errors in the accounting entries. The trial balance (debit=credit) is a good indicator for this.

- Detect internal anomalies that do not comply with current accounting standards.

- Better manage cash

- Better manage the possible risks that can impact the financial situation of the company

- Make comparisons of financial indicators over time (between two years for example)

- Make comparisons of the financial situation of one company compared to another (in a group of companies for example)

- Evaluate the creditworthiness of the company as well as request new credit from a financial institution

- Evaluate the financial capacity necessary to make new investments internally (product innovation, acquisition of equipment, recruitment of personnel, targeting of a new market, etc.)

- Optimize the production rate

- Review employees’ salaries and see if salary increases are possible in order to motivate them more

- Develop an effective strategy to improve the financial health of the company

Objectives of financial statements for external users

Financial statements help shareholders and outside investors get a clear idea of the investment potential in a business. The income statement and the profit statement are useful indicators to decide whether they invest more in a company or withdraw from it.

For creditors, financial institutions rely on financial statements to decide whether or not to grant credit to the company. For public organizations, the objectives of financial statements are based on the needs of their users, and take into account the limitations of financial statements as a means of information, the nature of government activities and legislative control.

How to read and understand financial statements?

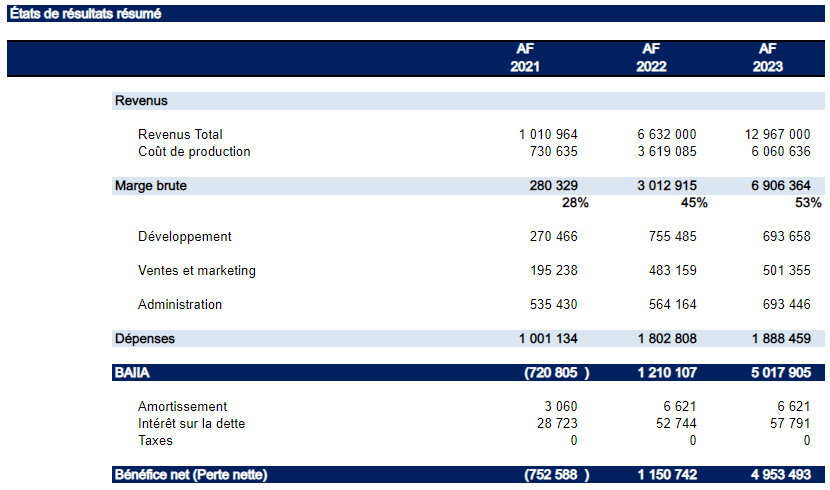

How to interpret the income statement

The income statement is presented for a given period: a month, a quarter or a year and it measures the financial performance of the company. It is generally the most used report, but it is not necessarily the best structured to help optimize asset management as well as the internal management of the company.

Too often companies use the chart of accounts found in their accounting software as a structure for their financial information. It is generally a very limiting presentation which does not allow to seek an interesting capacity of analysis. With our years of experience, we have become accustomed to presenting income statement information in the following manner:

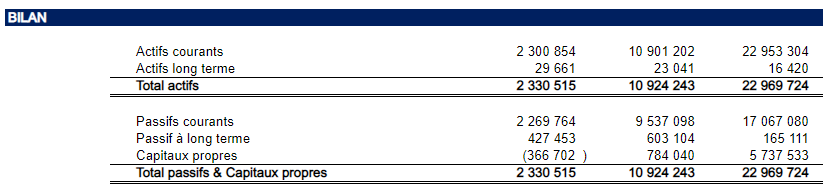

How to interpret the balance sheet

The balance sheet is a picture of the company’s financial situation on a given date. We often present a comparison with the same period the previous year in order to see the evolution of the financial situation of the company, for example the variations of equity.

The balance sheet is made up of three sections: assets, liabilities and shareholders’ equity or equity (both terms are used).

Assets and liabilities are separated into short-term and long-term (more than 12 months). Shareholders’ equity includes share capital and retained earnings, that is, realized profits that have not yet been distributed in the form of dividends.

Certain financial ratios calculated from the balance sheet make it possible to validate the financial health of the company. If you want to keep only one ratio, keep this one:

The working capital ratio = Current assets / Current liabilities

This ratio allows you to see if you will be able to meet your short-term commitments. For example, you have in your asset class cash of $20,000, accounts receivable of $50,000 for current assets of $70,000.

In your liabilities, you have the balance of your credit cards $5,000, accounts payable $15,000, salaries payable $10,000 and taxes payable $10,000 for a total of $40,000. Your working capital is $30,000 or 1.75 (the ratio).

Depending on the industry, a ratio below 1.25 could be problematic and you could run out of cash in the short term. A ratio above 2 could indicate that you are not maximizing the money available and that it is “sleeping” in the business.

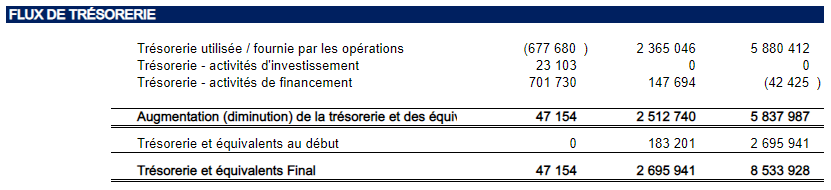

How to Interpret a Business Cash Flow Statement

Operating cash

We start with the company’s net profits from which we subtract the items that have no impact on cash. Then, it is necessary to make the variation of balance sheet items such as accounts receivable and accounts payable. This is a very technical statement, but be sure to remember that it allows you to distinguish whether your current activities have generated cash during the period or whether they have consumed it.

As the business grows, it often happens that accounting becomes more complex. Managing on the basis of cash inflows and outflows is no longer sufficient. We may have work in progress, income received in advance and other accounting items that change the way in which we must analyze our financial statements.

Looking at a company’s cash flow allows us to assess whether current operations generate cash. The cash flow statement shows how a business received funds and how it spent them over a period of time. It is also a tool that measures a company’s ability to cover its short-term expenses.

Generally speaking, if a business regularly brings in more money than it spends, it is considered profitable. A cash flow statement is divided into three parts: operating, investing, and financing .

Investment cash

Some companies invest outside of their main activities or acquire new companies to extend their field of action or new equipment to improve performance.

It can also involve investments to develop a web platform which will then be marketed in the form of a subscription. A distinction can therefore be made between cash required for current operations and cash used to add assets to the business.

Cash from financing

This last section refers to the movement of cash from financing activities . Two common fundraising activities involve taking out a loan or issuing stock to new investors. Dividends paid to current investors also fall into this category, as do repayments made on company loans.

Interpretation

Cash flow is found in a lot of new cloud software like Zoho Books and it’s easy to look up. If you have access to this type of software, you should take the time to understand how the cash generated by your business is used.

Other things to consider

Gross margin

The gross margin is interesting because it makes it possible to calculate the profitability in relation to the resources that are allocated to the production of goods and services. By dividing the margin by the revenue, we have the margin as a percentage, so it’s easy to determine if the company’s performance is holding up over time.

A segmentation of operating costs is important. For each of the costs, ask yourself the question, is this activity carried out in order to produce a good or a service. If so, the expense should be classified as production costs (often called direct costs, cost of goods sold or cost of services rendered).

Operating costs

Many accountants present operating expenses in a single cost group. For my part, I like to separate the cost of development, sales and marketing activities from the cost of administration costs. For what? Because these costs vary differently from administrative costs and should not be analyzed in the same way.

Development costs do not apply to all companies. They are often found in companies that do research and development or in SAAS companies that develop their digital platform.

For my part, although being a service company, I use this section to evaluate the costs associated with the development of work methods and tools that we create to help us in our mandates. I consider these costs as an investment, but I still want to measure the costs, because it is a choice that I make to devote money to it.

If you want to grow quickly, more marketing efforts will be required, but in the short term this should not result in additional administrative costs. By dividing the cost of sales and marketing by revenue, you can see the proportion of costs to fetch revenue. By analyzing your sales growth, you can see if the additional sales and marketing efforts are paying off. It will be easier to analyze your sales performance as well.

Earnings before interest, tax and amortization (EBITDA)

EBITDA, or earnings before interest, taxes and amortization, presents the funds generated by the company’s operations. The higher the EBITDA, the better the business performs.

It is a ratio which makes it possible to compare companies between them. A business with no debt and a business with debt will not have the same net income, but may have similar EBITDA. It is also a good indicator for a company that must, for example, buy new equipment that will be financed by debt.

New equipment adds an interest expense to repay the loan as well as amortization to assign a cost for this new asset. If the company increases its EBITDA following this purchase, it is because there is a gain in productivity associated with the new equipment, it is interesting to be able to see the effect on performance.

What EBITDA should you aim for? This is the question I am often asked. There is only one answer. Knowing that we invest in investments (RRSP or other) and that we expect a return between 7% and 15%, it should be the same for your business.

Depending on the industry, the level of maturity of the company and the investments required, a minimum EBITDA of 7% allows you, if you do not have too many fixed assets and debts, to pay the taxes and to pay a dividend. Conversely, you should aim for much higher EBITDA if you have a lot of debt to repay, as you need to generate enough cash to meet your obligations.

Need the services of an accountant?

If you wish to improve the financial situation of your company, Cofinia provides you with a team of accounting experts who offer you personalized solutions. Our team relies on financial modeling and business intelligence to optimize the development and analysis of financial reports.