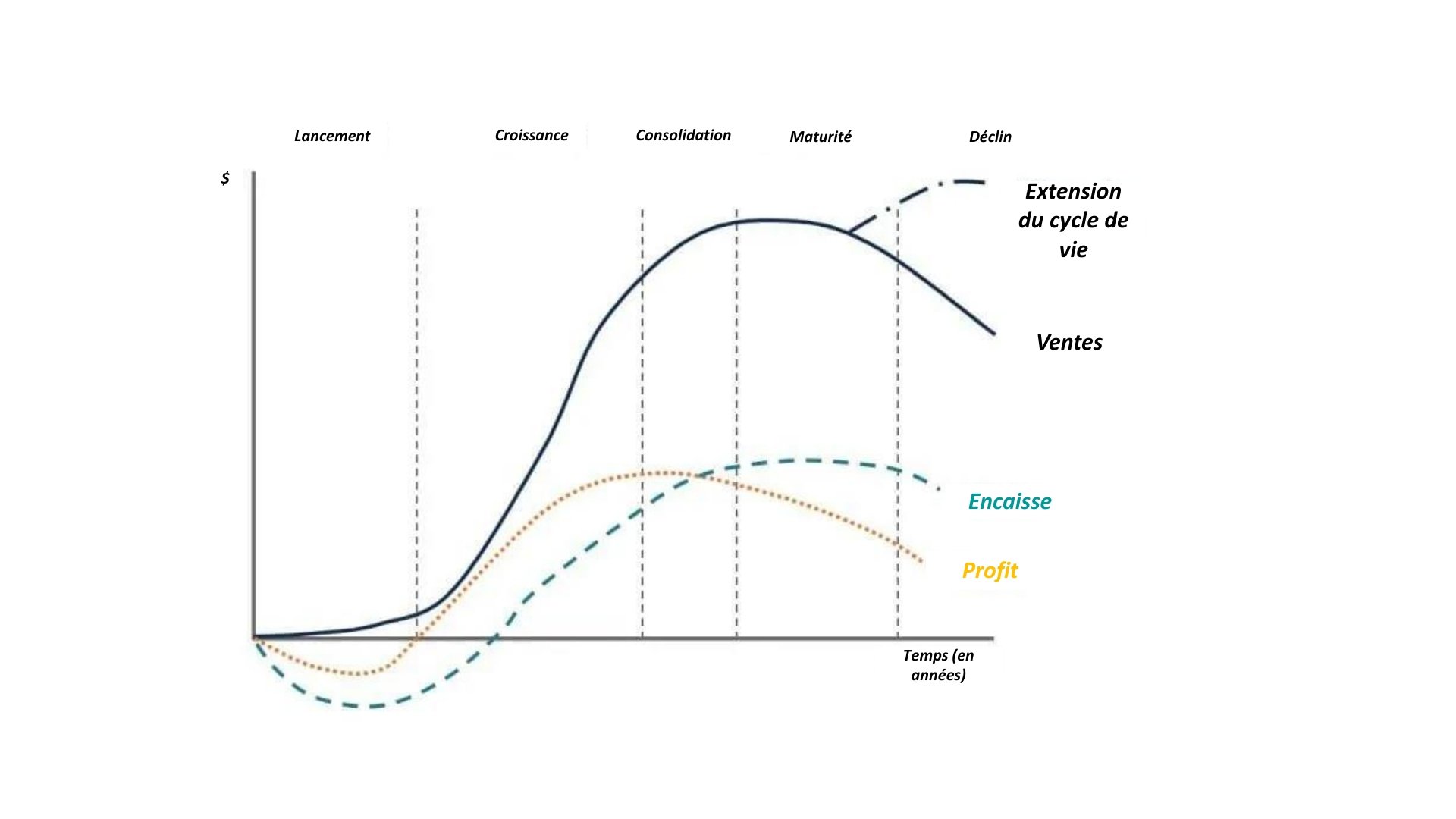

For each stage of its development, a company needs a means of financing adapted to its growth. Whether it’s equity to launch a project, credit to support its business development or propel new products to market, entrepreneurs must establish a financing strategy to ensure the sustainability and expansion of their long-term businesses.

What are the stages of business growth?

Identifying business life cycles allows managers and investors alike to:

-

-

-

-

- Prepare adequate measures to face different challenges and risks

- Take advantage of potential economic opportunities

- Choose appropriate funding sources

-

-

-

.

.

Business life cycle

( Source )

( Source )

1. Getting Started

After validating the project study and identifying the target market, the start of production and sales of products or services begin. Based on own funds for the acquisition of equipment, premises and personnel if necessary, it is important in this phase to invest in marketing by remaining attentive to customer feedback in order to refine the products according to their expectations. Since revenues are low and initial start-up costs high, businesses are likely to incur losses during this stage.

2. Growth

In this phase, companies generate rapid sales growth allowing them to break even and earn a profit. During this phase, entrepreneurs need a well-established financial plan to “boost” their sales and the implementation of a marketing strategy to overcome the challenges and threats coming from the competition.

3. Consolidation

The consolidation phase is characterized by a continuous increase in sales, but at a slower pace due to market saturation or the entry of new competitors. It is necessary to explore new markets by relying for example on the innovation of products or services.

Optimize your sales with an intelligent CRM

4. Maturity

When the business reaches the mature stage, sales begin to slowly decline. Thus, profit margins are shrinking, while cash flow remains relatively stagnant.

However, it is important to note that many companies extend their life cycle during this phase by reinventing themselves and investing in new technologies to gain segments in emerging markets. This allows entrepreneurs to reposition themselves in their sectors and renew their growth .

5. Decline

In the absence of the implementation of a new marketing and financial strategy, sales, profits and cash flow all decrease. During this phase, companies come to terms with their failure to extend their life cycle by adapting to the changing business environment. They end up losing their competitive advantages and leaving the market.

What are the preferred sources of financing depending on the growth stage of your business?

The accessibility to financing and its cost are determined throughout the life cycle of the company according to the level of risk envisaged by each phase. The company’s risk decreases as it makes sales involving the growth of liquidity and profitability.

Funding for the start-up phase

At this stage, the company has a large operational risk. Thus, the agents interested in financing are the entrepreneur who wants to invest in his idea, his relatives who wish to support him and the investors ready to invest their capital in a risky idea, but which presents a strong potential return.

The first source of financing for the company is the down payment by the associates, their friends and their relatives. As the company makes sales, it strengthens its power to convince outside investors of the potential of its business.

At the start-up stage, angel investors can also offer financing. They are often business people with a high risk tolerance, extensive management experience and an objective to grow their investment in the medium and long term before selling their shares. Government loans are also interesting financing tools for SMEs.

Funding for the growth phase

At this stage, the company still presents risks at the operational level, but its sales increase significantly and its liquidities become positive, as does its profitability threshold. Thus, new investors are ready to finance the company, because the risk of having a negative return on investment becomes increasingly low. Unlike the start-up stage, these investors are now institutional and not just individual.

Venture capital companies are companies made up of different partners specializing in the private investment of young companies with high potential. The investment comes from the various partners. Generally, these partners require a significant return and therefore, this means of financing is relatively expensive.

In addition, the venture capital company is interested in active participation in the governance of the company and will therefore own significant shares in it, in addition to occupying a place on the board of directors. These companies are expert in management and have a large network of contacts, making them important allies in the growth of a business.

Institutional and corporate investors can invest directly in the company or by becoming partners in a venture capital company. Their interests are financial and strategic. These are usually pension funds, insurance companies or foundations.

Financing of the consolidation phase

Funding at the level of the consolidation phase is a continuation of the previous stages. Angel investors probably want to get out of their position and sell their shares to another angel or to the company directly.

Funding for the maturity phase

Financing at this stage opens at the level of indebtedness, the issuance of long-term debt and the public issuance of shares. Banks are interested in lending money to the company if the latter is now able to demonstrate sufficient financial health to repay the loan.

Banks will always be willing to finance, but as the company matures and becomes profitable, the terms are more attractive to the business as it carries less risk in the eyes of lenders.

Banks will then analyze working capital, interest coverage and debt ratios. Forecast financial statements are also requested to support the financial health of the company.

Adequate use of debt is very important for companies, because interest payments are tax deductible, which allows a reduction in the cost of financing the firm. The company can itself issue debt via commercial bonds. It will therefore obtain direct financing from its creditors in exchange for fixed payments.

The public issuance of shares is done on public stock exchanges. The company pays a fee to a subscriber (usually a broker from a large bank) who will ensure the sale of the new shares issued to the various investors, whether private, institutional or individual.

Financing of the consolidation phase

This stage is not characterized by a particular financing method. Generally, existing funding at that time may stagnate, as the company has less need for liquidity resulting from operational decline.

It is important to know that the financing methods above are not exclusive to each stage of growth. The idea here is to show when the company can obtain a type of financing depending on its stage of development. Of course, as a business evolves in its life cycle, the previous means of financing are still available to it.

Would you like to consult an expert in financial management?

The financial management of a company is not a task to be taken lightly, especially in an increasingly uncertain economic environment. With its expertise in accounting , financial modeling and business intelligence , Cofinia is able to support you throughout the life cycle of your business by offering you personalized solutions allowing financial stability, whatever the challenge encountered.

Get a consultation