For your business to be successful in the long term, budget management is crucial. However, this can be a time-consuming task. In this article, we explain what Zoho Books can do for businesses and how to start budgeting with the software.

What is Zoho Books?

Zoho Books is an intelligent, cloud-based accounting system designed to help small and medium-sized businesses meet their accounting needs and simplify their financial management.

It allows you to manage all your business invoices in one safe place, balance your bank statements, manage your expenses and cash flow, keep an eye on projects and forget about BAT compliance issues. With Zoho Books, you can create and send invoices, track time and expenses, and generate reports. Zoho Books is simple online accounting software that syncs with your bank accounts and credit cards and covers all the essentials.

SMBs need reasonably priced software that can grow with their business. Zoho Books offers three pricing tiers , like many other accounting software platforms. You benefit from a more economical rate if you decide to pay annually rather than monthly.

- Three users are supported with the Standard plan at $15 per month. You can track mileage and expenses, create invoices, reconcile transactions, manage projects and timesheets, and process up to 50,000 invoices, see full plan features here https://www.zoho . com/ca/books/pricing/ .

- The professional plan allows five users to benefit from a subscription of $40 per month. In addition to everything included in the basic plan, you can also create sales orders, manage purchase orders, issue recurring invoices, and work with multiple currencies.

- The Premium plan, which supports 10 users, costs $60 per month. Everything covered by the other two subscription plans is included, plus a vendor portal, custom domain, budgeting tools, and connection with Twilio and Zoho Sign.

What can Zoho Books do?

Unlike most other accounting software , Zoho Books saves you from spending endless hours entering data. As a result, you will have more time and energy to devote to growing your business.

Accounting is one of the most tedious facets of running a business . Zoho Books’ automation of management tasks and online payment capabilities greatly help businesses reduce the time and money spent on bookkeeping.

Here are the different ways Zoho Books can optimize your financial operations:

- Increased Automation : By streamlining your workflow, Zoho Books saves you time. The software can be configured to automatically perform things like sending regular invoices and payment reminders, tracking costs, and alerting you when your invoices are due. When transactions are imported daily from your bank feed, you can set up bank rules to automatically categorize them. The software detects potential matches when you reconcile your accounts.

- Efficient invoicing : You can easily turn sales orders or estimates into invoices, edit invoices as needed, and drag lines to reorder them. You also have the option to send them immediately or set a later time for them to be sent. The software maintains an audit trail, allowing you to see which transactions are linked, who generated or modified them, and when the modification was made.

- Online Payments : You can link your account to well-known payment processors like Authorize.Net, Braintree, PayPal, Square, Stripe, WePay, Worldpay, and 2Checkout to allow your customers to pay their bills online immediately. So you can receive money and track paid and unpaid bills more efficiently. Plus, it gives your customers a simple and easy way to pay for your goods and services.

- Mobile app : Like many other accounting apps, Zoho Books has a mobile app. Zoho Books’ app really stands out because it works on more platforms than others, including Windows phones, Android phones, tablets, smartwatches, iPhones, iPads, iMessage, Apple Watch, and Android phones. .

Invoices and quotes can be managed, payments and costs can be tracked, receipts can be uploaded, reports can be generated and your dashboard provides you with key information. Also, it allows multiple users, and you have control over what data they can access.

Project management and inventory tracking tools are available on Zoho Books. It offers task management plans, and you have the option to charge a fixed amount, project hours, task hours, or staff hours.

How to reduce accounting costs

How to manage a budget with Zoho Books

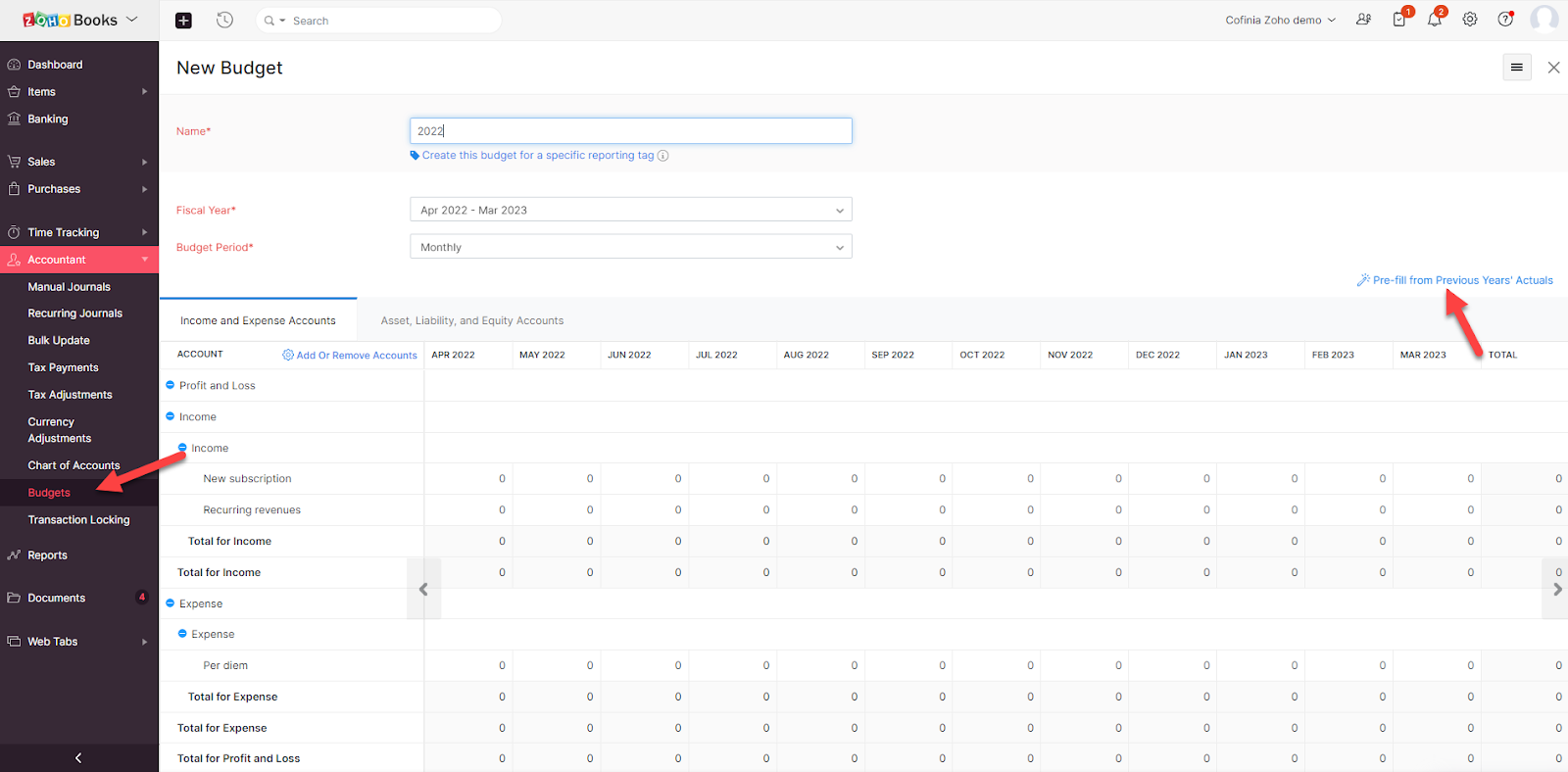

1. Create your budget

It can be time consuming to manually enter amounts for each period when creating budgets. Luckily, with Zoho Books, you can budget using one of three techniques. You can:

- Automatically populate your cost and revenue accounts

- Pre-fill based on actual data from previous years

- Enter data manually

Creating a budget based on the first period is a common budgeting technique. Using this strategy, you will estimate your budget for future periods. You can enter the budget for the first period in Zoho Books and then specify an amount or percentage by which it should increase or decrease for the next period. The budget amount will be automatically populated for each period (monthly, quarterly, or semi-annually) when you apply the change.

Here are different ways to auto-fill your amounts:

- Apply a fixed budget for each period.

- For each period, increase by a certain amount.

- For each period, adjust by a certain percentage.

- Pre-fill based on actual figures from the previous year.

You can pre-populate your budget using previous years’ actuals if you want to use the previous year’s actuals as a baseline. You can increase the pre-filled amounts by an absolute amount, or by a percentage for each time period if your business is expected to perform better than previous years.

Similarly, you can autofill amounts with a downward adjustment if you want to initiate budget reductions. You can also manually enter amounts for each period if you need to create budgets for your income and expense accounts that are separate from each other and don’t follow a pattern.

2. Evaluate your organization’s performance and compare actual results to budgets

You should compare the actual performance of your business to the budgets you set for it at the end of each financial period . You can use a detailed report in Zoho Books to compare your budgets with your actual results. You can find a list of accounts in this report with their budgets, accomplishments, and variances. You can find which accounts are over budget by looking at trends between actuals and budgets. Then you can take appropriate action to bring these accounts under budget in the future.

3. Make wise choices

Once you’ve established your budget and compared it to the actual performance of your business, it’s important to find the areas that need your attention . It will be easier for you to make decisions about how to spend more efficiently in the future if you identify problem areas in your business. This knowledge will help you set more reasonable goals and set your business on the path to success.

Zoho Books Consulting Services

Effective accounting platforms are beneficial for small and medium-sized enterprises (SMEs) in Quebec. Building in-house knowledge usually costs a lot of money, and the benefits can take time to show. With payroll software, two clicks are all it takes.

Budget management is simplified for both businesses and employees when software is used. If you’re looking for a secure and affordable way to manage taxes, social benefit deductions and payroll for your employees, look no further than Cofinia. Our Zoho Books experts can help you optimize your accounting and financial operations.